Token Economics

As Polkadex is a multi-feature project, PDEX was designed to be used for multiple functions.

Polkadex native token will be used to:

- Pay transaction and trading fees to get discounts on them

- Participate in Polkadex IDOs

- Participate in on-chain governance of the network

- Become a validator of the network by staking

- Nominate validators and collators of the network

Now let’s take a deep dive into the core elements of Polkadex tokenomics.

Total supply

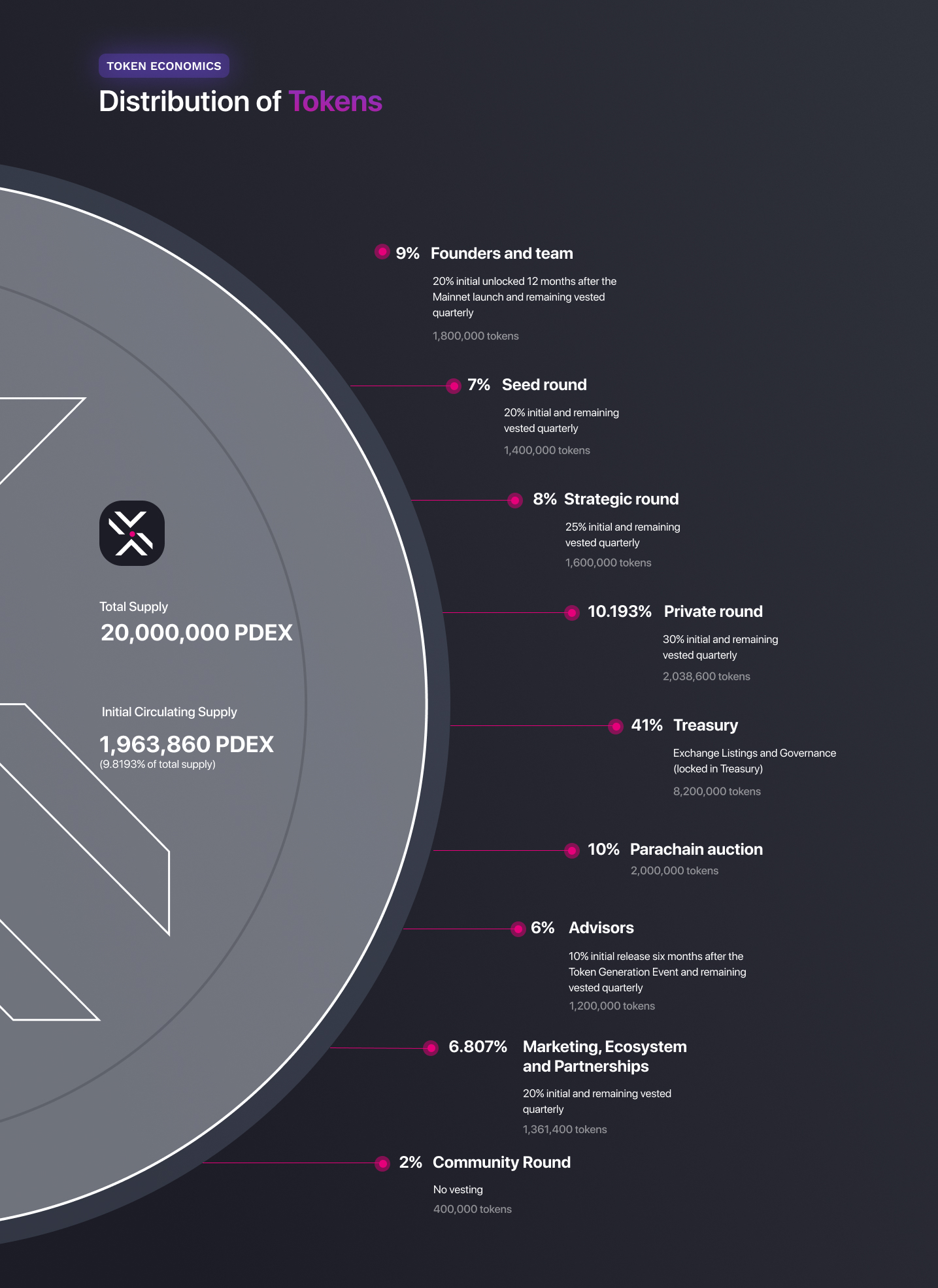

The total supply of Polkadex native token, PDEX, is capped at 20 mln. However, PDEX supply can fluctuate at times.

How does it work?

PDEX token is inflationary, but Polkadex uses an automatic system of burning tokens self-regulated by the network itself.

The supply can move between 18 mln and 22 mln tokens at certain periods, but it will always come back to fixed 20 mln tokens in total in the long run. Polkadex mechanism will burn the transaction fees if the current total supply goes over 20 mln tokens. We are also working on other mechanics of burning tokens from the Polkadex IDO pallet and Orderbook that will be introduced later. Burning mechanisms regulate supply via the network without the need for users to intervene.

Initial Circulating Supply

There are 1,963,860 PDEX tokens currently released on the market. It is less than 10% of the Total Supply.

Polkadex is in the Testnet version at the moment. With PDEX being an ERC-20 token now, it makes sense to release a limited supply of tokens. The remaining tokens will be minted in the Mainnet and distributed in tranches at later stages of the product launch.

Founders and team

Our core team building the product receives 9% of the total supply of tokens, 1.8 mln PDEX. They are released according to the following schedule: 20% of tokens is unlocked 12 months after the Mainnet launch and the remaining amount is vested quarterly over the next 12 months.

Investors

Polkadex was raising money through several investment rounds. Our early backers who joined at seed, strategic and private stages receive 7% (1.4 mln tokens), 8% (1.6 mln tokens) and 10.193% (slightly over 2 mln tokens) of the total supply, respectively. All the unlocks happen according to the vesting schedules.

Seed round investors are allocated 20% of tokens unlocked after the Token Generation Event earlier this month and remaining vested quarterly over the next 12 months.

Strategic round investors are allocated 25% of tokens unlocked after the Token Generation Event and remaining vested quarterly over the next 12 months.

Private round investors are allocated 30% of tokens unlocked after the Token Generation Event and remaining vested quarterly over the next 12 months.

All investing rounds ended in February 2021.

We are proud to say that Polkadex is backed by the most prominent and respected institutional and private investors in the blockchain space.

Choosing the right investors was very important for us because it is not just a one-time funding thing. Our early investors are the people who share their knowledge, expertise and industry connections to help Polkadex become better, faster and stronger every day throughout the lifetime of our product.

Treasury

The biggest chunk of tokens, 41% (8.2 mln), is locked up in the Treasury. These tokens are reserved for giving grants to extend the Polkadex ecosystem, building bridges to other blockchains and governance of the Polkadex Network.

Treasury is locked by on-chain governance and can be released only by votes of users. Further details of the unlock process and voting system will be in the on-chain proposal.

Parachain auction

10% (2 mln) of the total number of tokens will be reserved for the Parachain auction.

Advisors

As Polkadex aims very high at solving issues of the current DeFi system and attracting mass users to the industry, we invited the best experts from blockchain, finance, legal and other industries to help us create the most efficient product and ecosystem. Our advisors receive 6% of the total token supply (1.2 mln) distributed according to the following schedule: 10% of tokens is released six months after the Token Generation Event and remaining vested quarterly over the next 12 months.

Marketing, Ecosystem and Partnerships

No efficient exchange can function with low liquidity. Hence, our users are the heart of our product. We intend to use 6.807% of the total supply (slightly over 1.36 mln tokens) to spread the word, educate the public and build a supportive community around Polkadex through marketing, as well as strengthen and expand our platform functionality through partnerships. Our marketing budget is relatively modest.

We believe that we are building the future of DeFi and want to collaborate with people & projects that share our vision, rather than just pay to be featured.

Our partners receive tokens according to the following schedule: 20% of tokens are unlocked after the Token Generation Event and the rest is vested quarterly over the next 12 months.

Community Round

2% (400 K) of tokens were released for Community Round as a part of the Token Generation Event through IDO & IEO earlier this month. There is no vesting for these tokens, as they were unlocked straight away.

This number might seem small at first but it makes perfect sense because we have to be precautious. Community is our key focus and we try to provide more opportunities for Polkadex supporters. That is why we are planning to have our on-chain governance that will fund teams building bridges to other blockchains and allow listings for their tokens, building their own ecosystems.